Woori Financial Group is set to transform its operations by adopting artificial intelligence (AI) as the cornerstone of its growth strategy, a move unveiled by Chairman Yim Jong-yong during the group’s 2026 management strategy workshop held on Friday in Seoul. The initiative underscores the belief that technology-driven productivity will enhance the group’s competitiveness, moving away from a traditional reliance on balance sheet expansion.

In his address to approximately 400 executives and employees, Yim described the past three years as pivotal for the group’s transition to full privatization, improved capital ratios, and the establishment of a robust portfolio encompassing banking, insurance, and securities services. He emphasized that 2024 will herald a new era characterized by productive and inclusive finance, integrated with a comprehensive AI transformation approach.

Central to this initiative is the concept of AX, or AI transformation. Woori intends to implement a total of 344 AI use cases by next year, with 200 designated for its banking operations and 144 for non-banking affiliates. These AI applications will be interwoven into various facets of management, operations, and risk management.

Yim highlighted that the integration of AI would play a critical role in shaping leadership within the financial sector. He stated that an expedited adoption of AI-driven decision-making processes is essential across all divisions of the organization. This strategic pivot is particularly relevant as Woori seeks to establish a stronger foothold in productive finance, a domain where it has historically excelled as a leader in corporate finance.

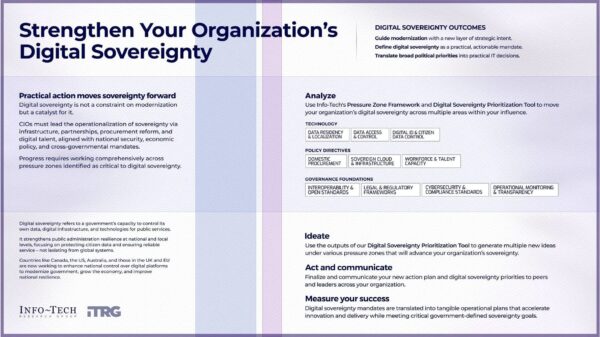

The group aims to bolster synergies across its banking, insurance, and securities sectors, projecting a growth target of 20 percent derived from non-bank operations. Woori articulated its commitment to harmonizing AI adoption with consumer protection and inclusive finance, aspiring to position itself as a leader in both technological advancement and social credibility within the financial landscape.

This strategic shift aligns with a broader trend in the financial industry, where institutions increasingly recognize the significance of AI in enhancing service delivery, operational efficiency, and risk management. As financial services evolve, organizations like Woori Financial Group are proactively adapting to technological advancements to maintain competitive advantage and respond to changing consumer expectations.

Looking forward, Woori’s initiative to embed AI into its core operations may influence not only its internal dynamics but also set a benchmark for the industry. As banks and financial service providers continue to explore the potential of AI, Woori’s approach could serve as a model for others aiming to leverage technology as a catalyst for growth and efficiency in the increasingly digital financial ecosystem.

See also Salesforce Reinvents CRM with Einstein 1 Platform and Generative AI for Efficiency Gains

Salesforce Reinvents CRM with Einstein 1 Platform and Generative AI for Efficiency Gains IBM Study Reveals AI Investment Set to Surge 150%, Driving 42% Productivity Growth by 2030

IBM Study Reveals AI Investment Set to Surge 150%, Driving 42% Productivity Growth by 2030 Moonshot AI Valued at $4.8B as Chinese AI Market Grows Amid Geopolitical Shifts

Moonshot AI Valued at $4.8B as Chinese AI Market Grows Amid Geopolitical Shifts SAP Tackles AI Skills Gap as ERP Systems Embrace Automation and Analytics

SAP Tackles AI Skills Gap as ERP Systems Embrace Automation and Analytics