Artificial intelligence (AI) platforms have rapidly transitioned from niche technologies to essential tools for millions of Americans. With capabilities ranging from generating quick recipes to crafting personalized workout plans, AI applications are increasingly integrated into daily life. Many individuals are also turning to AI for assistance with financial guidance, reflecting a growing reliance on technology for managing personal finances.

According to FNBO’s 2025 Financial Wellbeing Study, 46% of Americans have utilized AI tools, such as ChatGPT, for personal finance assistance, while an additional 50% express trust in AI for offering financial advice. These figures underscore a notable trend where everyday users leverage AI’s analytical power to enhance their financial decision-making.

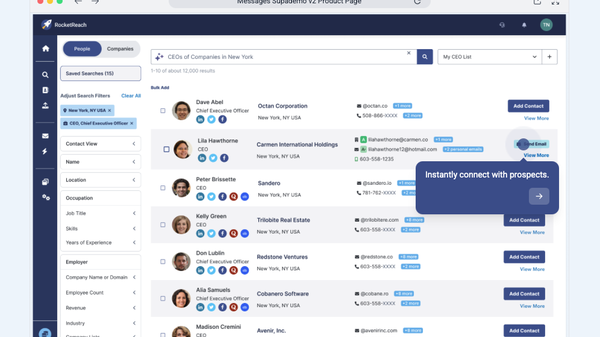

The utilization of AI in financial services is multifaceted. Many banks and financial platforms now employ AI to enhance customer support through chatbots, detect fraudulent activities, generate credit scores, and provide tailored product recommendations. Tools like ChatGPT and Gemini empower users to devise personalized financial strategies and budgets, making advanced financial planning more accessible.

“The steps a good planner takes, reviewing cash flow, spotting blind spots, stress-testing goals, aren’t magic. They’re methodical,” explained Andrew Latham, a certified financial planner at SuperMoney.com. “AI can learn to do that well, as long as it gets the right data and context.” He emphasized that while the gap between AI capabilities and human certified financial planners (CFPs) is narrowing, human advisors offer unique advantages such as relationship-building, accountability, and emotional guidance—elements that current AI technologies cannot replicate.

Despite the rapid advancements in AI, concerns persist among users and experts regarding security and privacy. The more information users provide to AI systems, the more personalized the advice becomes; however, this practice raises the risk of scams and potential breaches of privacy. A 2024 study by PYMNTS.com revealed that many consumers are apprehensive about their growing dependence on technology and the associated risks to their personal information.

A 2025 IBM report highlighted that 13% of organizations have reported breaches involving AI models or applications, with an additional 8% uncertain about whether they had been compromised. “The data shows that a gap between AI adoption and oversight already exists, and threat actors are starting to exploit it,” said Suja Viswesan, vice president of security and runtime products at IBM. Viswesan urged that as AI becomes entrenched in business operations, the security of these systems must be prioritized to safeguard sensitive data and maintain user trust.

AI platforms can serve as invaluable tools, especially for individuals who may not have access to in-person financial advice. However, users are encouraged to take steps to protect their privacy and engage with AI tools more responsibly. Latham advises users to review the privacy policies and settings of the platforms they utilize. Understanding how data is handled and making informed choices regarding information sharing is crucial.

In addition, it is recommended that users avoid oversharing personal details with AI systems, as doing so can complicate privacy concerns. While AI can assist in exploring financial scenarios and comparing products, final decision-making should remain firmly in the hands of the user. “Use AI to expand your thinking, not to outsource your judgment,” Latham cautioned. He emphasized that while AI is a powerful resource for evaluating options and understanding trade-offs, personal values, risk tolerance, and common sense should guide ultimate decisions.

As AI technologies continue to evolve, the landscape of personal finance management is poised for significant transformation. While the integration of AI can facilitate smarter financial choices, users must remain vigilant about privacy and security concerns. This interplay between technology and human oversight will shape the future of financial advisory services, as both AI and human advisors strive to meet the diverse needs of consumers.

See also Finance Ministry Alerts Public to Fake AI Video Featuring Adviser Salehuddin Ahmed

Finance Ministry Alerts Public to Fake AI Video Featuring Adviser Salehuddin Ahmed Bajaj Finance Launches 200K AI-Generated Ads with Bollywood Celebrities’ Digital Rights

Bajaj Finance Launches 200K AI-Generated Ads with Bollywood Celebrities’ Digital Rights Traders Seek Credit Protection as Oracle’s Bond Derivatives Costs Double Since September

Traders Seek Credit Protection as Oracle’s Bond Derivatives Costs Double Since September BiyaPay Reveals Strategic Upgrade to Enhance Digital Finance Platform for Global Users

BiyaPay Reveals Strategic Upgrade to Enhance Digital Finance Platform for Global Users MVGX Tech Launches AI-Powered Green Supply Chain Finance System at SFF 2025

MVGX Tech Launches AI-Powered Green Supply Chain Finance System at SFF 2025