Core Scientific’s Strategic Shift Amidst Market Pressures

BTIG recently upgraded Core Scientific to a Buy rating, reflecting a significant strategic pivot from Bitcoin mining to providing high-density infrastructure and colocation services tailored for artificial intelligence (AI) and high-performance computing (HPC) clients. This transition represents a marked change in the company’s business model, focusing on power, cooling, and specialized hosting for third-party workloads, rather than merely mining Bitcoin on its own balance sheet.

Core Scientific’s new direction is underscored by its commitment to enhancing its hosting capabilities. The company is actively working to execute its substantial CoreWeave hosting pipeline, ramping up operations at newly opened facilities, such as those in Auburn, Alabama. Investors are keenly observing whether this growth trajectory can translate into profitability for a business that has been grappling with negative equity and a constrained cash runway.

While BTIG’s upgrade is anchored in expectations for increased contracts in HPC colocation and additional power capacity, it does not alleviate the balance sheet pressures the company faces. Core Scientific’s high price-to-sales multiple and limited liquidity remain primary concerns. The recent governance changes and leadership turnover further contribute to the uncertainty surrounding the company’s future.

Core Scientific’s investment narrative is largely contingent on whether investors can embrace its transformation from a Bitcoin miner to a key player in the AI and HPC infrastructure market. The company’s short cash runway could significantly influence its operational capabilities in the near term. In light of these challenges, some analysts have raised concerns that Core Scientific may be trading at a value above its estimated worth.

Analysts from Simply Wall St have presented varied fair value estimates for Core Scientific’s stock, ranging from $26.53 to $37.71. This disparity highlights contrasting views among investors regarding the company’s potential upside, particularly in light of its reliance on lucrative AI hosting contracts. The company’s valuation reflects the broader execution risk and existing balance sheet strains that have left many investors cautious.

In navigating these complexities, Core Scientific’s leadership faces the dual challenge of demonstrating growth while addressing critical financial concerns. The investment community is tasked with weighing these competing perspectives as they formulate opinions on the company’s long-term viability.

As Core Scientific attempts to redefine itself, investors are encouraged to engage actively with varied analyses and consider how different narratives might influence the company’s future trajectory. The landscape remains fluid, and the industry is closely watching how effectively Core Scientific can leverage its expertise in high-density infrastructure to carve out a competitive niche in the burgeoning AI and HPC markets.

In conclusion, while Core Scientific is attempting to pivot towards a more sustainable business model, the path ahead is fraught with challenges. These include executing on ambitious infrastructure plans, navigating financial constraints, and mitigating investor concerns about valuation and governance. The focus now shifts to whether the company can successfully turn its strategic vision into tangible outcomes that resonate positively with the market.

For more insights on companies leading the next generation of technology, including advancements in quantum computing, visit IBM Quantum Computing and Nvidia’s Quantum Initiatives.

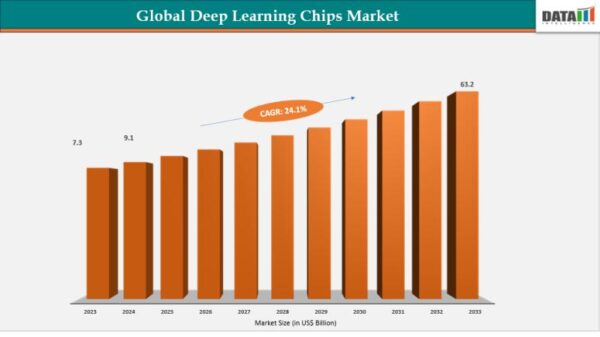

See also Invest in AI’s Future: Top 4 Stocks—Nvidia, AMD, Broadcom, TSMC—Set for Explosive Growth by 2026

Invest in AI’s Future: Top 4 Stocks—Nvidia, AMD, Broadcom, TSMC—Set for Explosive Growth by 2026 Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere

Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere 95% of AI Projects Fail in Companies According to MIT

95% of AI Projects Fail in Companies According to MIT AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032

AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032