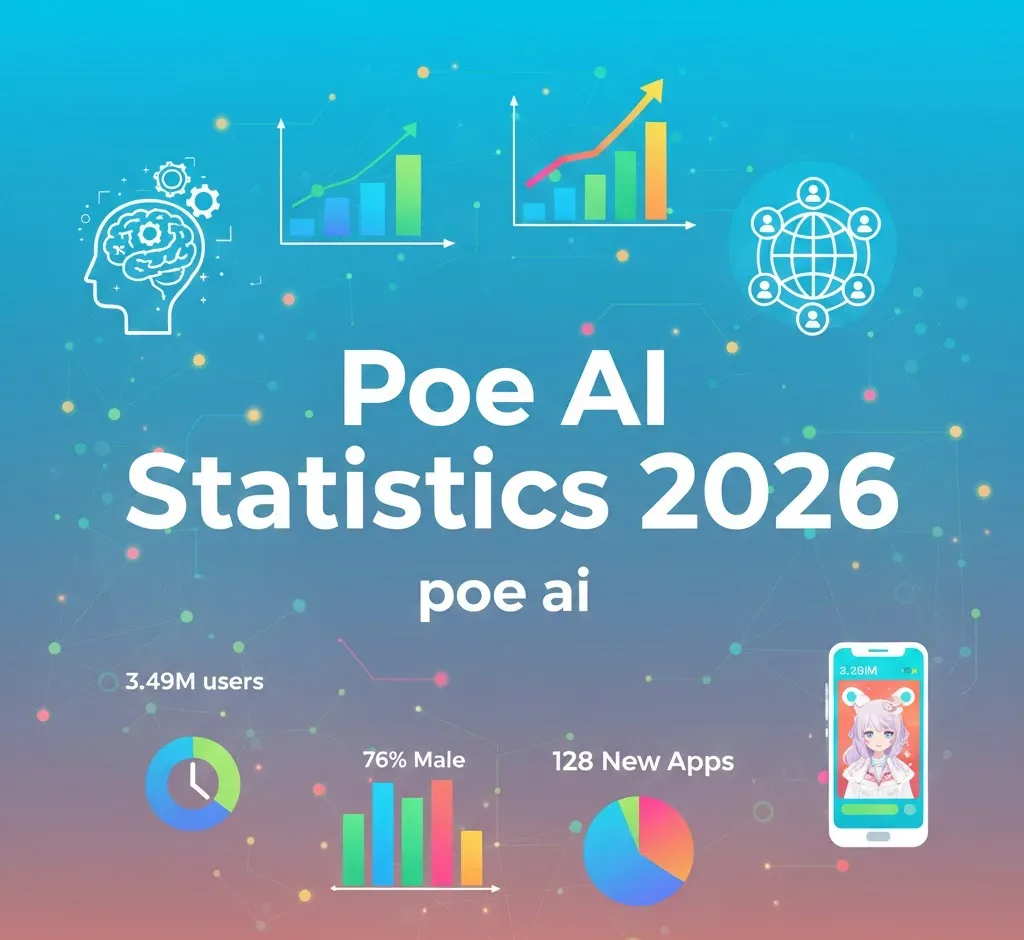

Joyland AI, an anime-focused AI companion platform, experienced a significant decline in user traffic after peaking at 5.4 million monthly visits in July 2025. By December 2025, visits plummeted by 35% to 3.49 million, indicating a worrying trend for the platform that launched in December 2023. The overall market for AI companion applications expanded to a valuation of $37.73 billion in 2025, with 128 new apps entering the competitive landscape during the same year.

As of December 2025, Joyland AI’s user demographics revealed a stark male predominance, with 76.54% of users identifying as male. This demographic skew is notably wider than that of its closest competitor, Character.AI, which has a more balanced user base (51.37% male). The United States emerged as the lead country for Joyland AI’s traffic, contributing 36.44%, followed by the United Kingdom at 7.48% and Canada at 3.72%.

Traffic data underscores a downward trajectory for Joyland AI’s user engagement. Monthly visits saw a steady decline from their mid-2025 peak, reflecting a drop in session duration from an average of 13 minutes and 44 seconds in July to just 9 minutes and 24 seconds by December. The bounce rate—indicating the percentage of visitors who navigate away from the site after viewing only one page—almost doubled, climbing from 33.09% to 54.59% in the same timeframe. This suggests that casual users may be abandoning the platform more quickly than new users can be attracted.

Most of Joyland AI’s traffic is derived from direct visits, accounting for 59.65% of desktop traffic, which indicates a strong base of users who actively seek out the platform. Organic search contributes 34.01%, with top-ranking keywords such as “joyland ai,” generating significant monthly search volume. Social media traffic, primarily from platforms like YouTube and Reddit, contributes a small share of around 5.5%.

Joyland AI operates on a freemium model, offering a free tier that provides users with 10 to 50 daily credits but restricts access to NSFW chat. The Standard subscription is priced at $9.99 per month, which includes NSFW access and 5,000 monthly credits, while the Premium plan, at $19.99 per month, offers unlimited credits and enhanced features. This pricing structure positions Joyland AI competitively within the broader AI companion app market, where subscription costs typically range from $8 to $25 per month. Industry data indicates that subscription revenue is a critical component, representing 70% to 85% of total income for such platforms.

The performance of Joyland AI’s Android app has also raised concerns. While it has accumulated about 220,000 downloads since its launch, recent monthly installs hover around 3,400. The app holds a modest rating of 2.50 out of 5 on Google Play, based on over 1,000 reviews, with common user complaints related to memory retention and conversation context. A secondary app titled “Joyland Anime World” launched with a more favorable rating of 3.76 but still pales in comparison to the performance of larger competitors like Character.AI, which boasted 20 million monthly active users in 2024.

The competitive landscape is stark, with Character.AI attracting between 180 million and 223 million monthly visits, dwarfing Joyland AI’s peak of 5.4 million by a factor of 40 to 60 times. However, Joyland AI does maintain a comparative edge over several smaller entrants in the market, such as Dippy.ai, which garnered only 374,000 visits. Despite the challenges in user retention and app performance, Joyland AI has facilitated the creation of over 50,000 user-generated characters, showcasing a degree of user engagement that could be leveraged for future growth.

As the AI companion app market continues to expand, projected to reach $140.75 billion by 2030, Joyland AI currently finds itself in a precarious position. While it outperforms many newcomers, the significant drop in user engagement metrics raises questions about its sustainability in a fiercely competitive environment. With a loyal core audience and potential for improvement, the platform’s ability to enhance user experience will be crucial in retaining and attracting users in the coming years.

See also Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere

Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere 95% of AI Projects Fail in Companies According to MIT

95% of AI Projects Fail in Companies According to MIT AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032

AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032 Satya Nadella Supports OpenAI’s $100B Revenue Goal, Highlights AI Funding Needs

Satya Nadella Supports OpenAI’s $100B Revenue Goal, Highlights AI Funding Needs Wall Street Recovers from Early Loss as Nvidia Surges 1.8% Amid Market Volatility

Wall Street Recovers from Early Loss as Nvidia Surges 1.8% Amid Market Volatility