Inscope has secured $14.5 million in a Series A funding round aimed at enhancing the adoption and capabilities of its artificial intelligence (AI)-powered financial reporting platform, which is tailored for both enterprises and their accounting firms. This funding round brings the company’s total financing to $18.8 million, which includes the $4.3 million seed round announced in June 2024.

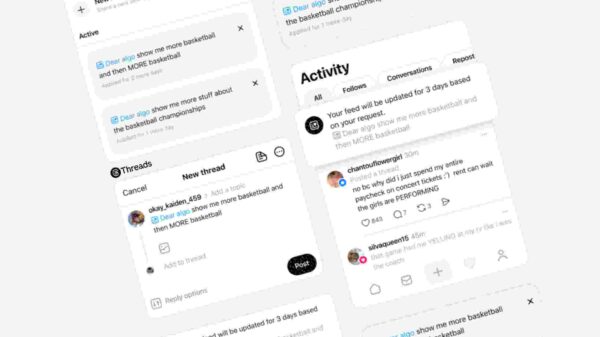

The new capital will be utilized to bolster Inscope’s engineering and go-to-market teams, while also expanding the platform’s functionality to better support complex reporting requirements, the company stated in a blog post on February 20. Inscope’s platform integrates AI into the financial reporting workflow of enterprises, enabling accounting teams to draft, roll forward, review, and validate financial statements, all while maintaining full audit trails and change control.

By adopting this technology, Inscope aims to eliminate the rework, version confusion, and audit risks that often arise from traditional manual methods, which typically rely on disconnected Excel files, static documents, and email-based review cycles. “Inscope provides the infrastructure teams need to produce high-quality, auditable financial statements at scale,” said Inscope Co-founder and CEO Mary Antony.

Designed not only for enterprises but also for the accounting firms that audit their financial statements, the platform facilitates collaboration and minimizes handoffs, ensuring better consistency and reduced risk of misstatements. “Inscope replaces brittle, manual handoffs with a system that supports real-world review cycles and last-minute changes without breaking,” added Inscope Co-founder and Chief Operating Officer Kelsey Gootnick.

Over the past year, Inscope has experienced significant growth, increasing its customer base fivefold and boosting its annual recurring revenue by over 30 times, according to the blog post. The Series A round was led by Norwest, which expressed optimism about the company’s potential in its own announcement. Norwest Partner Sean Jacobsohn and Investor Gabrielle Rush noted, “As companies push to close faster, improve accuracy and gain real-time operational visibility, the replacement cycle is accelerating. Inscope is redefining the system of record for financial reporting, and setting a new standard for how trust, automation, and intelligence coexist in the Office of the CFO.”

The growing importance of AI in financial reporting is underscored by a recent PYMNTS Intelligence report titled “What Happens When CFOs Get Serious About Gen AI.” Among the ten finance processes surveyed, financial reporting emerged as the most critical, with nearly 87% of CFOs indicating that generative AI plays a vital role in enhancing this area.

As the financial landscape continues to evolve, Inscope’s advancements may set new benchmarks for efficiency and accuracy in financial reporting. The increasing integration of AI technology not only promises to reduce errors but also serves to enhance the reliability of financial data, which is crucial for decision-making at the highest levels of business management.

See also Finance Ministry Alerts Public to Fake AI Video Featuring Adviser Salehuddin Ahmed

Finance Ministry Alerts Public to Fake AI Video Featuring Adviser Salehuddin Ahmed Bajaj Finance Launches 200K AI-Generated Ads with Bollywood Celebrities’ Digital Rights

Bajaj Finance Launches 200K AI-Generated Ads with Bollywood Celebrities’ Digital Rights Traders Seek Credit Protection as Oracle’s Bond Derivatives Costs Double Since September

Traders Seek Credit Protection as Oracle’s Bond Derivatives Costs Double Since September BiyaPay Reveals Strategic Upgrade to Enhance Digital Finance Platform for Global Users

BiyaPay Reveals Strategic Upgrade to Enhance Digital Finance Platform for Global Users MVGX Tech Launches AI-Powered Green Supply Chain Finance System at SFF 2025

MVGX Tech Launches AI-Powered Green Supply Chain Finance System at SFF 2025