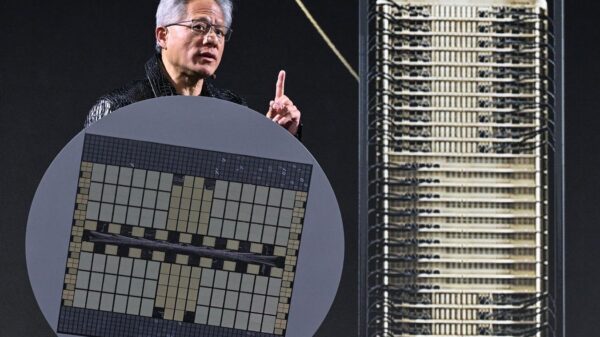

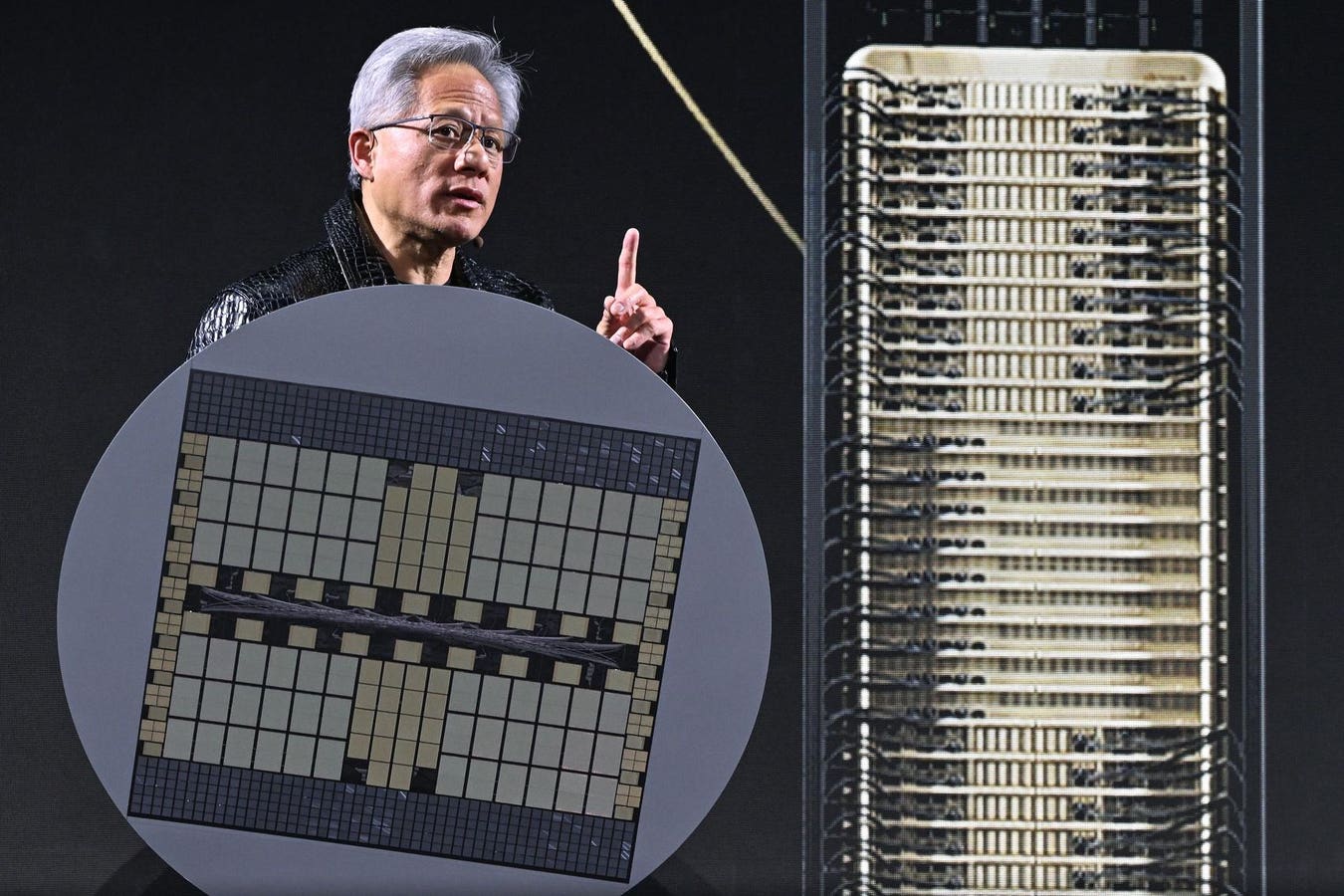

LAS VEGAS, USA – JANUARY 06: Nvidia CEO Jensen Huang addressed participants at the keynote of CES 2025 in Las Vegas, Nevada, unveiling a range of new chips, software, and services aimed at reinforcing Nvidia’s leadership in artificial intelligence computing. The presentation underscored the company’s continued innovation across various industries, reflecting the growing importance of AI in shaping market dynamics.

As artificial intelligence accelerates demand and geopolitical tensions reshape supply chains, markets appear to misprice risk by analyzing these forces in isolation. This segmentation leads to capital misallocation and blind spots around execution risk, resulting in surprises when projects stall or timelines slip. Current market dynamics are influenced by three powerful forces: the rise of AI, geopolitical factors, and critical mineral shortages. Each of these components is often evaluated separately, which masks their interconnected impacts on the market.

AI is primarily viewed as a demand and productivity driver, with analysts focusing on adoption curves and capital expenditures while assessing long-term growth potential. The central question revolves around how quickly AI can scale and which firms stand to gain. On the other hand, geopolitical challenges are treated as external risks, with analysts assuming that they can be managed through diversification or relocation strategies. Critical minerals and energy inputs are frequently treated as mere cost variables, rather than as essential elements that dictate project feasibility and sequencing.

The challenge lies in the fact that while these forces are reasonable to analyze independently, they increasingly interact to shape market outcomes. AI raises expectations around growth and competitiveness, while critical minerals and energy systems impose tangible constraints that affect timelines and execution. Geopolitical factors dictate where and how these constraints impact industries, making understanding their interplay crucial for informed investment and strategic planning.

As pressure builds upstream, constraints materialize long before they are reflected in earnings or macroeconomic data. The dynamics can be observed in certain sectors, for instance, where data center buildouts have outpaced grid upgrades and transformer manufacturing, or advanced manufacturing projects have advanced quicker than permitting and energy availability can support. These scenarios illustrate how the interaction of AI demand and global supply chain constraints affects project timelines and capital flows.

The intersection of AI-driven demand and supply chain realities offers a telling example of the market’s evolving landscape. Investment in AI is channeling capital into data centers, grid infrastructure, advanced manufacturing, and high-performance hardware. Markets interpret this as a straightforward growth narrative, with rising demand and expanding capacities. However, when viewed holistically, the risks associated with this growth trajectory become evident.

The implications of this interaction are most pronounced in financing, where capital flows quickly into projects based on anticipated demand. Yet, the necessary physical systems and inputs required to execute these projects often lag behind. Elements such as processing capacity, energy availability, and skilled labor tend to expand unevenly, constrained by geopolitical factors that influence where this capacity can be developed.

This results not in a demand issue but an execution bottleneck that compounds unnoticed until it escalates into financing challenges. By the time such delays become apparent through revised timelines or increased capital costs, leverage has shifted toward those controlling the bottlenecks, rather than those with the most promising growth narratives. What may appear as isolated execution problems are, in fact, early indicators of a broader reallocation of power and value along supply chains.

As these interactions intensify, the most significant market shifts are increasingly occurring before they become apparent in traditional economic indicators. Markets often overvalue the destination—higher demand and faster growth—while underestimating the paths required to achieve those outcomes. In a system characterized by physical constraints and political coordination, the pathways are pivotal in determining who captures value and who bears risk. Understanding how AI, geopolitics, and critical inputs coalesce is becoming essential for a comprehensive grasp of market trajectories, particularly across sectors like semiconductors, grid modernization, and defense supply chains, where demand is clear but execution remains constrained.

For further insights, visit the official pages of Nvidia, OpenAI, and Microsoft.

See also Lao PDR Launches National AI Strategy, Leveraging UNESCO Ethics for Inclusive Growth

Lao PDR Launches National AI Strategy, Leveraging UNESCO Ethics for Inclusive Growth Anthropic Updates Claude’s 80-Page Constitution to Shape AI’s Ethical Framework

Anthropic Updates Claude’s 80-Page Constitution to Shape AI’s Ethical Framework Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere

Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere 95% of AI Projects Fail in Companies According to MIT

95% of AI Projects Fail in Companies According to MIT AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032

AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032