Reddit Inc. shares surged by 5.3% in the latest U.S. trading session, closing at $241.89 on Friday. This uptick was buoyed by a positive assessment from Needham analyst Laura Martin, who posited that the platform is increasingly becoming a significant source for AI-generated search citations. The market is shifting focus, as consumers move away from traditional search links towards AI-generated summaries produced by large language models (LLMs), and Reddit’s content is being cited more frequently in these outputs.

The implications of this trend are considerable. Investors are becoming bullish on Reddit’s potential to monetize this increased exposure through advertising and licensing opportunities. As Martin noted, if Reddit continues to be a primary source for AI-driven interactions, it could effectively transition economic value from mere clicks to valuable citations.

The current market sentiment is underscored by remarks from Philadelphia Fed President Anna Paulson, who stated that further rate cuts “could take a while.” This commentary adds urgency for investors, as it raises concerns for high-growth tech stocks, which typically rely on favorable interest rates for valuation support. The juxtaposition of Reddit’s burgeoning role in the AI space with a more cautious interest rate outlook presents a complex landscape for tech investors.

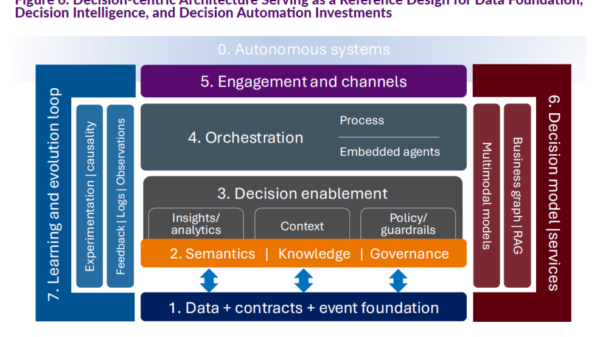

Martin’s analysis highlights that Reddit could be evolving into what she describes as “the new homepage for the Open Internet.” This shift is supported by research suggesting that Reddit is cited in approximately 20% to 40% of AI-generated answers. Consequently, the company’s data-licensing segment is currently generating over $120 million annually and has the potential to increase significantly, especially if ongoing legal disputes concerning data scraping are resolved.

As reported, Reddit has established licensing agreements with major players like Alphabet and Microsoft-backed OpenAI, while also pursuing legal action against entities allegedly engaging in unauthorized data scraping. The resolution of these issues could further enhance Reddit’s revenue opportunities.

Investor optimism has been echoed by various analysts, with Jefferies reportedly setting a Street-high price target of $325 for Reddit shares. Alongside this, firms such as Piper Sandler and Needham have reiterated their buy-equivalent ratings, indicating a consensus on Reddit’s strong potential moving forward.

The broader market context remains mixed. The SPDR S&P 500 ETF, which serves as a benchmark for the index, saw a modest increase of about 0.2%, while the Invesco QQQ Trust, which is heavy on tech stocks, dipped by approximately 0.2%. Within the ad-supported internet sector, stocks showed varied movement: Meta Platforms fell 1.4%, while Pinterest climbed 2.7% and Snap gained 0.6%. Alphabet also experienced a rise of 0.7%.

On the trading chart, Reddit fluctuated between $228.44 and $242.69 on Friday, closing just below the session’s high. Traders will be closely monitoring whether the stock can maintain support above the $230 level and surpass the $243 resistance threshold in the near term.

As the market heads into next week, macroeconomic data is likely to play a pivotal role in shaping investor sentiment. Key upcoming reports include the ISM manufacturing index on Monday, along with ADP employment figures and the ISM services report on Wednesday. The U.S. Employment Situation report for December is also set for release on Friday at 8:30 AM ET, which could further influence market dynamics.

With the Federal Reserve’s next policy meeting scheduled for January 27–28, any adjustments to rate expectations are anticipated to significantly impact high-multiple tech stocks. Although company-specific catalysts are limited for the week ahead, investors will be keenly awaiting Reddit’s fourth-quarter earnings release, projected for February 17. Key metrics to watch will include advertising growth, user engagement trends, and updates regarding licensing and legal disputes that could shift revenue dynamics.

See also British Rowers Pause Transatlantic Race to Rescue Entangled Sea Turtle, Highlight Ocean Conservation

British Rowers Pause Transatlantic Race to Rescue Entangled Sea Turtle, Highlight Ocean Conservation MicroStrategy Shifts Focus from Bitcoin to AI Strategy for 2026: A $59B Pivot

MicroStrategy Shifts Focus from Bitcoin to AI Strategy for 2026: A $59B Pivot Renowned Fallout Artist Deimos Rejects AI, Elevates New Vegas Art with Unique Vision

Renowned Fallout Artist Deimos Rejects AI, Elevates New Vegas Art with Unique Vision Google’s AI Misguides Users with Dangerous Medical Advice, Reports The Guardian

Google’s AI Misguides Users with Dangerous Medical Advice, Reports The Guardian