Financial services firms are entering a transformative era where artificial intelligence (AI) underpins hyperautomation, enhancing routine processes into intelligent systems that can predict, adapt, and scale. A study conducted by IDC and commissioned by Microsoft Industry Blogs in November 2025 reveals that leading firms achieve returns on AI investments three times higher than those lagging behind, driven by agentic AI that orchestrates complex workflows.

Hyperautomation integrates robotic process automation, machine learning, and generative AI to foster adaptive ecosystems. FUJIFILM Business Innovation identifies ten key trends, which include predictive forecasting and AI-driven client communication, emphasizing augmentation over replacement. According to PwC’s 2024 AI Jobs Barometer cited in the report, the financial sector’s productivity is growing nearly five times faster due to exposure to AI.

KPMG Australia’s Future of Corporate Services survey encourages a focus on data value streams and generative AI, advocating for an empowered workforce. As 2026 approaches, these tools are streamlining processes; financial closes that traditionally took days can now be completed in hours.

Agentic AI Takes Command

Agentic AI, which is capable of planning, reasoning, and executing multi-step actions, represents a significant advance from basic automation. BDO anticipates that fintech companies will lay the groundwork for advanced agents by 2026, differentiating themselves by operating autonomously within established guardrails. For instance, these agents can monitor payments in real-time, proactively blocking suspicious transactions before they occur.

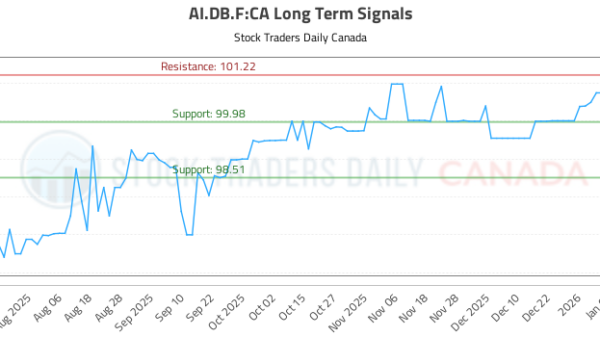

The global market for AI agents in financial services, valued at $1.79 billion in 2025, is projected to reach $6.54 billion by 2035, growing at a compound annual growth rate (CAGR) of 13.84%, according to Precedence Research. Banks currently hold a 40.5% share of this market, while fintechs are experiencing the fastest growth at a 28.5% CAGR. These AI applications encompass areas such as fraud detection, credit scoring, and compliance.

On social media platform X, users like @0xSammy have noted innovations like Coinbase’s AI financial advisor and agent-to-agent payments, highlighting how crypto-native firms have an advantage over legacy systems burdened by outdated technology. McKinsey reports that AI is set to enhance productivity in investment banking by 27% and boost front-office operations by 27% to 35% by 2026.

The first trend identified by FUJIFILM is predictive analysis, which leverages AI to transform historical data into insights about trends, risks, and cash flows. This proactive shift allows for better resource allocation and sustainable growth. KMS Technology predicts that the AI banking market will reach $315.50 billion by 2033, fueled by automated loan approvals in regions such as Australia.

Microsoft forecasts that success in 2026 will depend on re-architecting business processes to be human-led and AI-operated. The blog states, “In 2026, success won’t come from experimenting with AI; it will come from re-architecting core business processes.” Tools like Cube’s FP&A platform automate variance explanations and pattern insights, bridging enterprise resource planning (ERP) systems and spreadsheets.

According to Protiviti’s Global Finance Trends Survey shared by @jacobcaudill73 on X, 72% of finance teams are now utilizing AI for forecasting, a figure that has doubled compared to previous years. This intelligence layer helps convert data overload into strategic roadmaps.

Risk and Compliance Go Real-Time

Continuous monitoring tools are increasingly used to track regulations, credit risks, and cybersecurity threats, as noted by FUJIFILM. TechInformed quotes Monica Hovsepian of OpenText, stating that “AI will become deeply embedded in core financial operations such as shifting from automated loan approvals to dynamic risk modeling.” Mid-market banks, as highlighted by @MartinSzerment on X, are now able to triage anti-money laundering (AML) and know your customer (KYC) alerts within minutes instead of hours.

Proactive compliance measures are essential as regulations grow more stringent. Leading firms incorporate responsible AI frameworks across their operations. Thomson Reuters’ RegTech reports that 95% of issues are flagged proactively, scanning over 10,000 regulations using natural language processing (NLP), according to Facile Technolab.

NVIDIA’s State of AI in Financial Services reveals that 89% of financial institutions report revenue gains and cost reductions stemming from real-time decision-making, as shared by @AudriTan. The integration of blockchain and AI ensures immutable audit trails.

Financial close automation is becoming more efficient as checklists compress timelines, allowing teams to focus on analysis, notes FUJIFILM. Journal entry automation using optical character recognition (OCR) and ERP integration reduces processing times from hours to minutes, while generating robust audit trails. HPE CFO Marie Myers commented, “AI will move beyond experimentation to become a core enabler of finance operations… automating quarterly close, forecasting, and analysis.”

Advanced bookkeeping processes can now handle reconciliations and statements at scale, with expense management AI categorizing, enforcing policies, and flagging excesses. Solvexia’s report on 32 trends indicates that 44% of teams are employing intelligent process automation, with 39% implementing anomaly detection.

As 2026 approaches, Tipalti emphasizes a focus on automating manual tasks to expedite financial closes. A post by @FutureStacked highlights an $8 billion fintech company where agents manage receipts, approvals, and reconciliations autonomously.

Client Interfaces Evolve with Chatbots

AI chatbots are revolutionizing customer service by providing real-time, personalized responses. FPT Software reports that modern assistants currently resolve 80% of banking inquiries, with aspirations to reach 90% by 2026, potentially saving billions. TransPerfect predicts that always-on access will become a standard expectation, fostering trust through explainable AI.

BDO points out the role of agentic AI in wealth management and trading optimization. Discussions on X from @BankingCIO emphasize the development of centralized generative AI models in banks. PwC sees AI as a tool for personalizing client experiences, which could unlock revenue opportunities without significantly raising costs.

FinTech Magazine anticipates that enterprise-wide generative AI programs will automate underwriting and risk analytics. As @sunny_in_spoon notes, legacy finance systems are beginning with bots for KYC processes but are poised to scale up to full operations with minimal disruption. As the financial services industry continues to innovate, the integration of AI is likely to redefine operational landscapes and customer interactions in the years to come.

See also Finance Ministry Alerts Public to Fake AI Video Featuring Adviser Salehuddin Ahmed

Finance Ministry Alerts Public to Fake AI Video Featuring Adviser Salehuddin Ahmed Bajaj Finance Launches 200K AI-Generated Ads with Bollywood Celebrities’ Digital Rights

Bajaj Finance Launches 200K AI-Generated Ads with Bollywood Celebrities’ Digital Rights Traders Seek Credit Protection as Oracle’s Bond Derivatives Costs Double Since September

Traders Seek Credit Protection as Oracle’s Bond Derivatives Costs Double Since September BiyaPay Reveals Strategic Upgrade to Enhance Digital Finance Platform for Global Users

BiyaPay Reveals Strategic Upgrade to Enhance Digital Finance Platform for Global Users MVGX Tech Launches AI-Powered Green Supply Chain Finance System at SFF 2025

MVGX Tech Launches AI-Powered Green Supply Chain Finance System at SFF 2025