Google has reported a significant uptick in its financial performance, exceeding previous growth projections in both revenue and diluted earnings per share (EPS) for fiscal year 2025. The technology giant’s year-on-year (YoY) revenue growth jumped from an anticipated 11% to an impressive 15%, while diluted EPS increased from a projected 32% to 34%. This aligns with trends established since 2023 and highlights Google’s robust performance in a fluctuating market.

Advertising, which remains Google’s most substantial revenue generator, demonstrated notable resilience, with growth accelerating from 7% to 15% by the close of FY 2025. This performance is crucial, particularly as advertising expenditures tend to peak in the fourth quarter of the calendar year, especially in the U.S., which has historically accounted for nearly half of Google’s total revenue.

The company’s cloud segment also exhibited remarkable growth, moving from a projected 27% to a striking 36% over the same period. Subscriptions similarly improved, ascending from a forecasted 13% to 19%. This growth positions Google favorably within the competitive landscape, especially as its cloud services lay the groundwork for its advancements in artificial intelligence (AI).

In FY 2025, Google’s cloud segment, a vital component of its AI strategy, concluded the year with a 15% share of total revenue. Despite a slight decline in advertising’s revenue share, it still constitutes approximately three-fourths of overall income. This duality of dependency on advertising and the burgeoning cloud business underlines Google’s stability amid evolving market conditions.

On January 28, Microsoft and Meta Platforms released their earnings reports for FY 2026 and FY 2025, respectively. The following day, Microsoft experienced a steep decline of nearly 10% in its stock value, while Meta saw an increase of roughly the same percentage. The divergent market reactions stemmed from the companies’ messaging: Microsoft’s CFO, Amy Hood, articulated that potential cloud segment growth was hindered by prioritizing in-house projects over customer needs. In contrast, Meta’s CFO highlighted AI’s direct benefits, showing measurable gains in ad clicks and conversions.

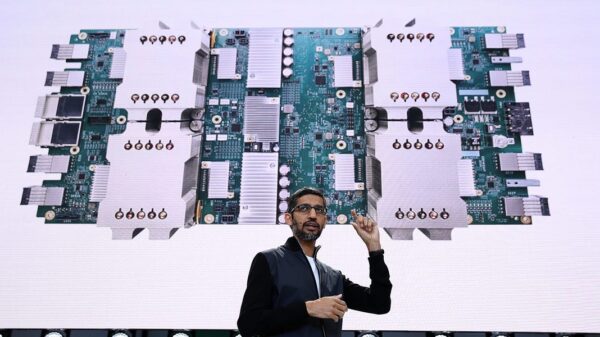

Similar to Meta, Google’s core business relies heavily on advertising. CEO Sundar Pichai noted that the company surpassed $400 billion in annual revenues for the first time, a milestone attributed to robust contributions from YouTube and cloud services. While these figures were impressive, they were largely consistent with Google’s historical growth patterns, indicating that much of this performance had already been anticipated by investors.

Pichai also underscored several advancements within Google’s AI segment. The latest iteration of its Large Language Model (LLM), Gemini 3 Pro, has been processing three times as many daily tokens compared to its predecessor, 2.5 Pro. Additionally, more than eight million paid seats of the Gemini Enterprise platform were sold since its launch, employed by 2,800 companies, including major clients like Wendy’s and Kroger.

Despite these advancements, metrics quantifying AI’s impact on Google’s core business remain unclear, creating uncertainty among investors. While the company has ramped up research and development spending, tripling expenditures compared to previous fiscal years, questions linger about the tangible benefits of these investments.

Looking ahead, Pichai indicated a strong demand for AI infrastructure, projecting capital expenditures (CapEx) between $175 billion and $185 billion for FY 2026. This forecast signals a potential 92-103% increase over FY 2025 if entirely allocated to new infrastructure, although some funds will likely be directed toward upgrading existing systems.

In FY 2025, Google saw a 74% increase in its investments in plants and property, predominantly reflecting datacentre expansions. The company has issued senior unsecured notes for a net total of $24.8 billion to support these general corporate objectives. With a net income of $132 billion for FY 2025, Google appears well-positioned to meet its ambitious CapEx commitments.

The recent earnings call notably avoided vague “AI deals,” instead reflecting a grounded approach focused on Google’s extensive client base. While the stability of Google is attractive to certain investors, the broader market sentiment remains unfulfilled, questioning the real impact of substantial investments in AI development. As the company continues to balance these dynamics, its performance must provide clearer metrics to satisfy investor expectations.

In the wake of its earnings release, Google experienced a modest rise in post-market trading on January 4 before settling back to a near-neutral position in pre-trading sessions on January 5. This muted response suggests that although Google presents stability, investors are seeking transparency and clarity regarding the efficacy of its AI initiatives in driving core business value.

See also AI Developed by UC Researchers Diagnoses Substance Use Disorder with 84% Accuracy

AI Developed by UC Researchers Diagnoses Substance Use Disorder with 84% Accuracy Amazon’s Anthropic Stake Surges to $60.6 Billion, Boosting AI Investment Value Sevenfold

Amazon’s Anthropic Stake Surges to $60.6 Billion, Boosting AI Investment Value Sevenfold Amazon, Google, Meta, Microsoft Announce $600B AI Capital Spending Plans for 2026

Amazon, Google, Meta, Microsoft Announce $600B AI Capital Spending Plans for 2026 Survey Unveils How 190 E&C Officers Leverage AI’s Benefits and Risks in Compliance

Survey Unveils How 190 E&C Officers Leverage AI’s Benefits and Risks in Compliance Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere

Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere